is stock trading taxable in malaysia

It is not taxable in Malaysia except for gains derived from the disposal of real property or on the sale shares in a real property company. Open a trading account in the country where the respective stocks originate from.

Advantages And Disadvantages Of Gst In Malaysia Financial Aid For College Tax Software Mortgage Interest

Depending on how often you trade shares and how the Inland Revenue Board Of Malaysia IRBM classifies you you might need to pay tax on the profits or gains youve made or you could be eligible for a tax exemption.

. 1 hour agoRTTNews - The Malaysia stock market bounced higher again on Wednesday one day after snapping the four-day winning streak in which it had jumped almost 40 points or 28 percent. In the history of Msia no individual has been taxed on trading profits. However as one reader wrote in most people are of the view that capital gains from stock investing in Malaysia are not taxable a perception that is propagated on the Internet.

The Kuala Lumpur. So no matter how much profit you make from your investment it is tax-free. The line between investing n speculating is hard to draw.

Whether youre a trader or investor this guide explains how much. In Malaysia taxable capital gains are those resulting from the sale and purchase of real estate. Does investing means u are not allowed to sell when u received fresh update that is detrimental to the stock u hold.

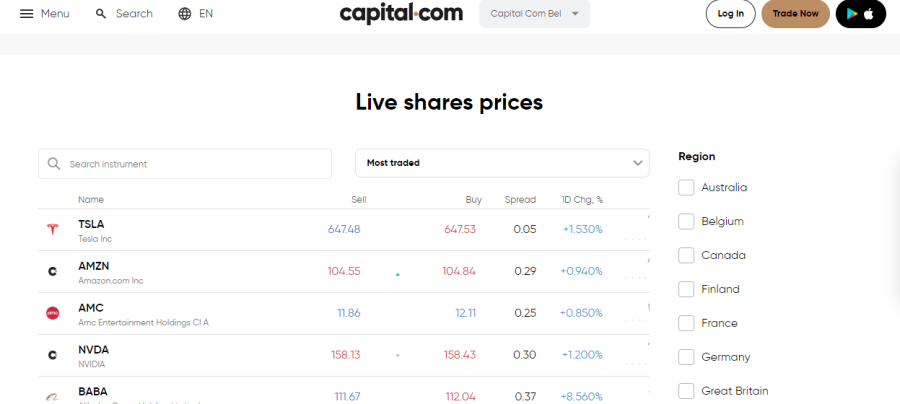

Any capital gains on shares are not subject to tax under the Malaysian Income Tax Act 1967 ITA. Income tax in Malaysia. A brokers online trading platform should let you enter orders and receive confirmations on your stock orders in addition to providing access to accurate stock quotes.

Capital gains are generally not subject to income tax in Malaysia. Yes its true one prominent stocks. This is because that income is not derived from the exercising of employment in Malaysia.

Therefore income received from employment exercised in Singapore is not liable to tax in Malaysia. Is forex trading taxable in Malaysia 2020 price list price today is forex trading taxable in Malaysia 2020 price guide is forex trading taxable in Malaysia. The value of the s tock in trade at the end of a basis period is the same value as the stock in trade at the beginning of the following basis period.

As such the value. However when it is frequent enough Inland Revenue Board IRB will treat it as an active income and do require income tax liability. For instance if you want to invest in an American company open a trading account in the US to buy shares at the New York Stock Exchange NYSE.

They plan to make all the trade and transactions of Bitcoins and other cryptocurrencies legal in Malaysia. In this way you can keep your transaction costs to a minimum. In 2022 the individual income tax has been reduced from 14 to 13 percent for resident taxpayers in the 50000 ringgit to 70000.

Its tax time again which means a couple of things if you trade shares in Malaysia. Because they are capital gains stock investment gains are tax-free Capital Gain Tax. So the gain cannot be subjected to tax payment.

In the covid pandemics current scenario Malaysias Security Commission has given complete approval to the countrys cryptocurrencies operations. Capital gains tax in Malaysia Malaysia does not tax capital gains on the sale of investments or capital assets other than those which is related to land and buildings. However if the activity of trading in shares is frequent enough the Malaysian Inland Revenue Board IRB may treat the gain as a revenue gain which will be taxable.

This is the IRBs further clarification on the perplexing issue. Use a foreign broker. The net profit gained from the share market is taxable if the transaction is done repeatedly.

Capital gain from stocks investment is not taxable in Malaysia but heres what you do which can cause it to be taxable. Generally income taxable under the Income Tax Act 1967 ITA 1967 is income derived from Malaysia such as business or employment income. For tax purposes the value of stock in tradewhich is taken into account in determining the adjusted income is ascertained in accordance with section 35 of the ITA.

This trading software. Since there is an economic crisis.

Top 7 Stocks To Buy In Malaysia Asktraders

Dividend Taxes Malaysia Archives Dividend Magic

Bursa Malaysia Stock Tips With A Strategy Returns Bursasaham Stockpicks Tradingstrategy Hotstock Mal Fundamental Analysis Trading Strategies Investing

How To Buy Stocks In Malaysia In 2022

How To Buy Stocks In Malaysia In 2022

How To Buy Stocks In Malaysia In 2022

Withdrawal Of Stock Tax Risks Crowe Malaysia Plt

Stocks Investing Capital Gain Is Taxable In Malaysia If You Do This Youtube

Stocks Investing Capital Gain Is Taxable In Malaysia If You Do This Youtube

How To Invest In Us Stock Market From Malaysia 2022 Guide

Esos What You Need To Declare When Filing Your Income Tax

Tax And Investments In Malaysia Crowe Malaysia Plt

How To Buy Stocks In Malaysia In 2022

How To Buy Stocks In Malaysia In 2022

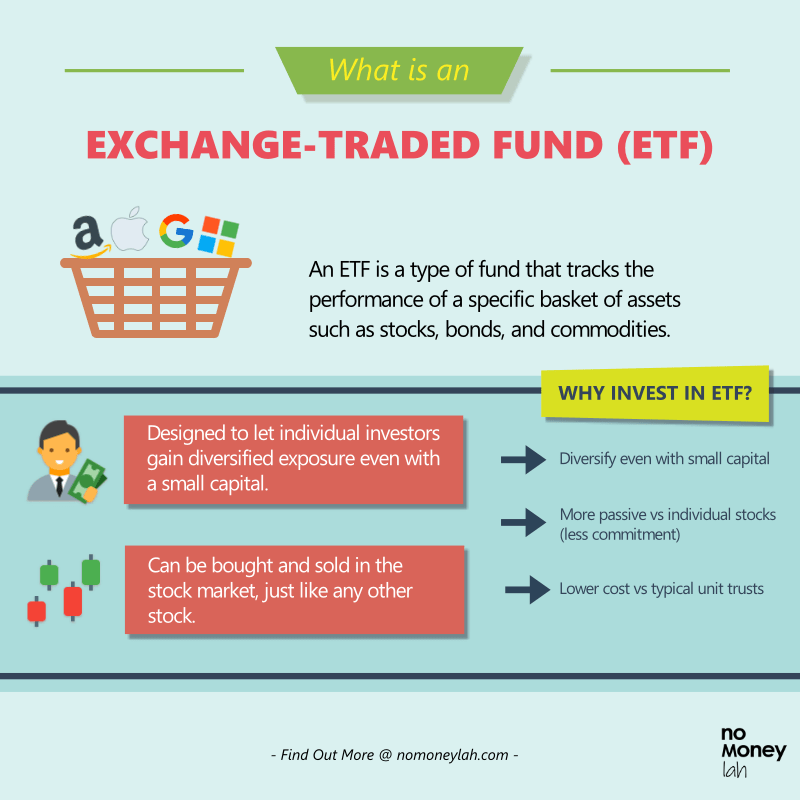

Malaysian S Guide To Invest In Etf No Money Lah

Stocks Investing Capital Gain Is Taxable In Malaysia If You Do This Youtube

Stocks Investing Capital Gain Is Taxable In Malaysia If You Do This Youtube

How To Buy Stocks In Malaysia In 2022

Restricted Stock A Comprehensive Guide Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor